Contents

Because an ECN broker consolidates price quotations from several market participants, it can generally offer its clients tighter bid/ask spreads than would be otherwise available to them. A carry trade where you are long the high interest currency and short the low interest currency. Excluding the volatility of the currency pair, this strategy is profitable based on the interest rate differential between the two countries.

- Forex is a huge network of currency traders, who sell and buy currencies at determined prices, and this kind of transfer requires converting the currency of one country to another.

- The regulatory agency responsible for administering bank depository insurance in the US.

- Therefore, as easy as it may seem to start online forex trading, it’s necessary to do your homework beforehand.

- The period of such deals can be from weeks to lasting for even several years and the size usually runs in millions of dollars on a single trade.

Most of the advanced traders and investors love StockCharts for its sharp charts which provide you detailed and accurate representations, and a variety of excellent indicators. Many traders move to software-based systems due to additional features offered as compared to web-based systems. Also, professional traders pay for the real time data which is official. The most important thing anyone would want is the cleanliness of charts because the more clean a chart you see, the more easy it becomes to draw patterns and conclusions.

Auto Trading

The pegged rate can be adjusted occasionally in an attempt to improve the country’s competitive position. You should be aware that the markets pertaining to forex exist as cash/spot markets. They can also exist as derivatives markets, offering currency swaps, futures and options. This Smart & Easy Guide will build your knowledge about forex trading and make you much better prepared for predicting currency behaviors and taking informed decisions. It gives you a strong conceptual framework to base your transactions upon. Lexa Trade is a platform offering trading in CFD, forex, commodities, shares & indexes.

But, E-payment options are not available for Australian and EU traders. The platform offers to trade CFDs in currencies, crypto, indices, shares, commodities and ETFs assets. XM offers MT4 and MT5 trading platforms across devices and even on the web through MT Web Trader. Get visibility of contracted commodities for both buyer and seller sides and expand smart farming services to farmers for better yield management through Connected Agri. The integration of lab systems provides quality analysis and visibility for inventory holdings to be used in the final pricing of deliveries.

Sales Forecast & Sales Strategy: Two Peas of the Same Pod?

Elearnmarkets is a complete financial market portal where the market experts have taken the onus to spread financial education. ELM constantly experiments with new education methodologies and technologies to make financial education effective, affordable and accessible to all. In the financial market, price tends to move at the equilibrium point before setting any direction. Therefore, this trading indicator provides a possible trading entry from the rejection of the pivot point. The Kumo Cloud is the first element of this indicator that helps to understand the market context. If the price is trading below the Kumo Cloud, the overall trend is bearish, and above the Kumo Cloud is bullish.

New FX traders can explore the video tutorials and gainfully use the copy trading option to get started trading. There are some common Forex chart indicators used to predict Forex charts, let’s check a few of them out. Typically, an asset’s price will experience a peak, before retracing back to a level of support. It will then climb up once more before reversing back more permanently against the prevailing trend.

To predict the movement of exchange rates, past market data is used, so traders are looking for patterns and signals. Previous price moves trigger patterns that technical analysts try to identify and, if they are correct, should signal where the exchange rate is heading next. There are many tools available to traders to identify patterns and signals. The concept of moving average is very important that every trader should know. The central bank and multinational companies drive the forex market. Therefore, it is important to understand what is happening at the macro level.

Types of Commodities You Should Consider Investing In

Also, this type of chart is often used in related trading strategies based on the chart and the EMA indicator, because it more accurately gives a signal to enter a trade. Whether you’re running a small business or a large corporation, sales forecast is an essential exercise that you must perform. Typically, sales forecasts help companies allocate their resources, manage their supply chains, estimate their cost of sales, devise sales strategy and more.

Something that all new traders tend to do is to enter the markets without an iota of caution. Now that trading has become so easy with online forex trading available to anyone with a smartphone, traders and investors are enthusiastic to trade. The idea of this book is to prevent zealous trading and to warn traders to take steps with care. An extremely practical and explanatory approach to trading is dealt with, making certain that readers and potential investors get a grip of the various drawbacks while engaging in forex market trading. You get a clue as to who the key players in the markets are, and which elements impact the currency markets the most. The forex market is among the most active and liquid in the world, with trillions of dollars changing hands between different currencies.

The term usually refers to additional Funds that must be deposited as a result of unfavorable price movements. It is uptrend when the market rates are going up and downtrend when they are coming down. It’s the indicator that suggests whether the price is in the uptrend or the downtrend. A person who does buying and selling to take advantage of the price movements to make monetary gains. A trading strategy that attempts to make many profits on small price changes. A trader who trades for short and quick profits rarely carrying the position to the next session.

Sonata Connected Agri Enables the World’s Largest Farmer Cooperative with a Single Source of Truth

As a result, for these specialists, the fundamentals of an asset are less important than the current balance between buyers and sellers. Sales forecasting is an integral part of any company’s strategy pepperstone broker review based on which you determine your hiring to resource management to goal-setting and budgeting needs. This forex indicator showcases the demand-supply balance levels of a pair of currencies.

This indicator is used to change the volume of a traded instrument, relative to its price. The volume precedes price and that it can be used to confirm price moves. Total daily volume is assigned a positive number if it increases, in comparison to the previous day and a negative value is assigned if total volume has decreased since the previous day. A divergence between the price and the OBV would indicate a weakness in the market move. RSI is a very popular momentum indicator that signals how much relative strength is left in a market move when the move may have dried up. The greater the difference between today and yesterday during the day – the stronger the impulse.

The Average True Range indicator is used to measure the market volatility. The key element in this indictor is the range, and the distinction between periodic low and high is called range. When it comes to measuring the price volatility of a particular security, the Bollinger bands indicator is used to determine the entry and exit points for a trade. If the price moves with a trend, corrects towards 61.8% Fibonacci retracement, and shows a market reversal, the price will likely move 161.8% Fibonacci extension level of the current leg.

The minimum first-time deposit varies from $50 to $10,000 based on your region and country regulations. You have the flexibility to choose the trade time and set the trade amount as per your trading convenience. I couldn’t be happier with my choice of using Web Design from Radian InfoSystems for my new website. Their team were easy to work with and helped me make a terrific website in a short amount of time.

Connected Platforms for Agri Ecosystem

This is bar on the historical price chart that displays the pair’s high, low, open, and close price for a specified period of time. Cable is one of the heavily traded instruments and is also considered one of the fastest pairs. The process of checking lexatrade review a trading method’s profitability over the historical price data. Investment practice that divides funds among different markets to achieve diversification for risk management purposes and/or expected returns consistent with an investor’s objectives.

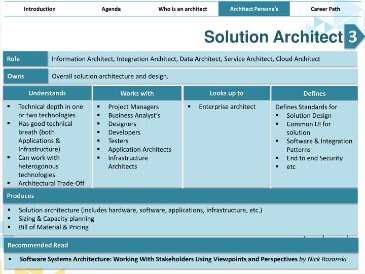

You will frequently come to hear of Contracts For Difference in forex broking. CFDs are over the counter derivative products, where you trade on the price movement of financial assets Solution Architect without actually owning them. To be trustworthy they need to be overseen by a major financial regulator having rigorous compliances on trading practices and client protection.